What Is the Difference Between a Dividend Yield and a Dividend Payout Ratio?

On the other hand, the dividend payout ratio offers a different perspective. This ratio reflects the percentage of earnings paid out to shareholders in the form of dividends. It is calculated by dividing the total amount of dividends paid by the company by its net income. A lower payout ratio suggests that a company retains more of its earnings to reinvest in the business, while a higher ratio indicates that a larger portion of earnings is distributed as dividends.

To illustrate this difference, consider a company with a high dividend yield but a low payout ratio. Such a scenario could imply that the company’s dividend payments are sustainable and not overly reliant on its earnings. Conversely, a high payout ratio combined with a modest dividend yield might indicate that the company is distributing a significant portion of its earnings, potentially leaving less room for future dividend increases or business expansion.

In essence, while dividend yield focuses on the relationship between dividend payments and share price, the dividend payout ratio centers on the relationship between dividend payments and a company’s earnings. Both metrics provide valuable insights into a company’s dividend policy and financial health, aiding investors in making informed decisions based on their investment objectives and risk tolerance levels.

Understanding these distinctions empowers investors to assess dividend-paying stocks more effectively, aligning their investment strategies with their financial goals and expectations for returns.

This article aims to provide a clear differentiation between dividend yield and dividend payout ratio in a conversational tone, using examples and explanations to engage and inform the reader effectively.

Decoding Dividends: Unveiling the Key Differences Between Yield and Payout Ratio

Firstly, let’s talk about dividend yield. Imagine you’re looking at a fruit tree in your backyard. The yield of that tree tells you how much fruit it produces relative to its size. Similarly, dividend yield measures how much a company pays out in dividends each year relative to its stock price. It’s like figuring out how much fruit you’re getting per tree trunk!

Now, what about payout ratio? Think of it as a portion of the fruit you’re picking compared to the total fruit the tree produces. In investment terms, the payout ratio is the percentage of earnings that a company distributes to its shareholders in the form of dividends. It’s a key metric to assess the sustainability of dividends. A low payout ratio suggests the company retains more earnings for growth, while a high ratio indicates that a significant portion of earnings is being distributed to shareholders.

Here’s the kicker: while dividend yield gives you an idea of how much income you might earn from owning a stock, payout ratio tells you whether that dividend income is stable and likely to continue in the future. It’s like knowing not only how much fruit a tree produces but also how likely it is to keep producing at that rate.

Investors often use these metrics together to gauge the attractiveness of dividend-paying stocks. A high yield might seem enticing, but if the payout ratio is unsustainable, it could be a red flag. On the flip side, a low yield with a healthy payout ratio could indicate a company that’s reinvesting in its growth while still rewarding shareholders.

Investor Insights: Understanding Dividend Yield vs. Dividend Payout Ratio

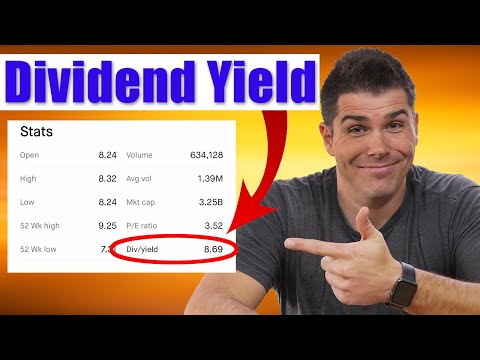

Dividend Yield is a critical metric for income-seeking investors. It represents the annual dividend payment divided by the stock price, expressed as a percentage. Essentially, it shows how much cash flow you can expect to receive from your investment relative to its current price. For example, if a stock has a dividend yield of 4%, it means you can expect a return of $4 for every $100 invested.

Investors often use Dividend Yield to assess the income potential of a stock. A higher yield might seem attractive at first glance, but it’s essential to consider the sustainability and growth potential of dividends over time. Companies with consistently high dividend yields may be more mature and stable but could also indicate limited growth opportunities.

On the other hand, Dividend Payout Ratio indicates the proportion of earnings paid out as dividends to shareholders. It’s calculated by dividing the total dividends by the net income of the company. A lower ratio suggests the company retains more earnings for reinvestment in business operations or future growth. Conversely, a higher ratio may indicate that a significant portion of profits is distributed to shareholders, which could be appealing for income investors but might limit growth opportunities.

Comparing these two metrics provides a balanced view of a company’s dividend policy. For instance, a high Dividend Yield paired with a sustainable Dividend Payout Ratio could signify a healthy balance between rewarding shareholders and maintaining financial stability. On the other hand, a high yield coupled with an unsustainable payout ratio might raise concerns about dividend sustainability in the long run.

Understanding Dividend Yield and Dividend Payout Ratio helps investors make informed decisions based on their financial goals and risk tolerance. By evaluating these metrics alongside other fundamental and technical factors, investors can better navigate the complexities of the stock market and build a diversified portfolio that aligns with their investment objectives.

Financial Fundamentals: Exploring the Contrast Between Dividend Yield and Payout Ratio

Dividend yield serves as a beacon for investors seeking income from their investments. It represents the annual dividend income expressed as a percentage of the current market price of a share. For instance, if a stock is priced at $100 per share and pays an annual dividend of $5 per share, its dividend yield would be 5%. This metric provides clarity on how much cash flow an investor can potentially generate relative to the price they pay for the stock.

Investors often favor stocks with higher dividend yields, especially in environments where interest rates are low, as they provide a steady income stream that can potentially outperform other investment options. However, a high dividend yield isn’t always indicative of a sound investment; it’s essential to assess the sustainability of the dividends through other metrics like the payout ratio.

The payout ratio complements the dividend yield by revealing the percentage of earnings a company pays out to shareholders in dividends. It’s calculated by dividing the total dividends paid by the net income of the company. A lower payout ratio suggests that the company retains more of its earnings to reinvest in growth opportunities or to buffer against economic downturns. On the other hand, a higher payout ratio indicates that a significant portion of earnings is distributed to shareholders as dividends.

Investors scrutinize the payout ratio to gauge the sustainability of dividend payments. A ratio exceeding 100% means the company is paying out more than it earns, which could be unsustainable in the long run. Companies with consistently high payout ratios may struggle to maintain dividend payments during challenging economic conditions unless they generate sufficient cash flow.

In summary, while dividend yield offers immediate gratification in the form of income, the payout ratio provides a lens into the financial health and sustainability of those dividends. Investors seeking income may prioritize stocks with attractive dividend yields but must also assess the payout ratio to ensure those dividends are sustainable over time.

Understanding these financial metrics empowers investors to make informed decisions aligned with their financial goals, whether it’s generating income, preserving capital, or achieving long-term growth. By balancing dividend yield and payout ratio, investors can navigate the complexities of financial markets with confidence and clarity.

Profit Payback: How Dividend Yield Differs from Dividend Payout Ratio

Have you ever wondered about the financial terms that impact your investment returns? Understanding the difference between dividend yield and dividend payout ratio can be crucial for making informed investment decisions.

Dividend yield is like the fruit you reap from your investment tree. It’s a percentage that shows how much a company pays out in dividends relative to its stock price. For example, if a stock is priced at $100 per share and pays an annual dividend of $5 per share, the dividend yield would be 5%. Investors often look at dividend yield to assess the income potential of a stock relative to its price.

On the other hand, dividend payout ratio is more like the portion of the fruit that the tree gives away. It represents the percentage of earnings that a company pays out to shareholders in the form of dividends. A higher payout ratio indicates that a larger portion of earnings is being distributed as dividends rather than retained by the company for other uses like growth or debt reduction.

To put it simply, dividend yield tells you how much income you could potentially earn from owning a stock, while dividend payout ratio indicates how much of a company’s earnings are being returned to shareholders. Both metrics are important, but they serve different purposes in evaluating stocks.

Imagine you’re comparing two fruit trees: one gives you bigger fruits (higher dividend yield) but doesn’t produce as many (lower payout ratio), while the other gives smaller fruits (lower yield) but gives away more of them (higher payout ratio). Your choice would depend on whether you prefer immediate income or long-term growth potential from the company.

Next time you’re researching stocks, keep these metrics in mind to make well-informed investment choices that align with your financial goals. Understanding how dividend yield and payout ratio differ can lead to smarter investment strategies and potentially higher returns over time.

Dividend Investing Demystified: Grasping Yield vs. Payout Ratio

Let’s start with yield. Imagine you have a fruit tree in your backyard. Every year, it produces a certain number of fruits. The yield of the tree is simply the amount of fruit it produces relative to its size. Similarly, in finance, the dividend yield of a stock measures how much cash flow you receive from owning that stock, relative to its price. It’s like knowing how juicy the fruits are compared to the tree’s height.

Next up, payout ratio. Think of a business as a chef who bakes delicious pies. The chef sells some pies to customers (this represents the dividends paid out), but also keeps some pies for future baking (this represents retained earnings for growth). The payout ratio tells you what proportion of the chef’s pies (or earnings) are being distributed to customers (shareholders) as dividends. It’s a way to gauge how generous the chef is with sharing his delicious pies.

For investors, understanding yield and payout ratio is crucial. A high dividend yield might seem attractive, like a tree with abundant fruit, but it could also indicate risks such as unsustainable dividends. On the other hand, a low payout ratio might suggest the company is reinvesting more of its earnings for growth, which can be positive for long-term investors seeking capital appreciation alongside dividends.

Comparing Dividends: Delving Into Yield and Payout Ratio Disparities

On the other hand, the payout ratio measures the proportion of earnings a company distributes to shareholders as dividends. It’s calculated by dividing dividends per share by earnings per share. A lower payout ratio indicates the company retains more earnings for growth or to handle unexpected expenses, potentially safeguarding against future uncertainties. However, excessively low ratios might imply missed opportunities for shareholders to benefit from profits.

Investors must balance these factors to gauge dividend sustainability and growth potential. A high yield coupled with a moderate payout ratio could indicate a stable dividend policy with room for growth. Conversely, a high yield paired with a high payout ratio might imply risks of dividend cuts if earnings decrease. Meanwhile, a low yield with a high payout ratio may suggest limited income potential despite robust earnings.

To illustrate, consider a garden where the yield represents the quantity of fruit harvested annually, while the payout ratio reflects the percentage of the harvest shared with neighbors. A fruitful garden with a generous harvest (high yield) and thoughtful sharing (moderate payout ratio) ensures sustainable goodwill and future fruitfulness. Conversely, a garden that over-distributes its yield (high payout ratio) risks exhausting its resources, potentially compromising future harvests.

Understanding yield and payout ratio disparities is essential for investors navigating dividend stocks. By evaluating these metrics in tandem, investors can make informed decisions aligned with their financial goals, aiming for both reliable income and long-term growth potential.